When facilities leaders talk about controlling Total Cost of Ownership (TCO), the conversation often starts with labor rates and response times. But for retail, restaurant, grocery, and convenience store portfolios, parts and materials quietly represent one of the most volatile and least governed areas of facilities spend.

Unlike labor, parts pricing is rarely standardized across providers. Two identical repairs can generate dramatically different invoices depending on how parts are sourced, marked up, or bundled. Over time, this inconsistency compounds, inflating TCO in ways that are difficult to detect through traditional facilities management (FM) processes.

The solution is not better catalogs or tougher negotiations. It is market intelligence. Dynamic benchmarking tools are reshaping how facilities teams manage parts and materials by anchoring pricing decisions to real market data instead of supplier-provided lists.

Why Parts and Materials Are a Hidden TCO Driver

Parts and materials are often treated as pass-through costs. As long as the repair is completed and the asset is back online, the invoice is approved. This approach assumes pricing accuracy, but in reality, it introduces significant exposure.

Supplier catalogs vary widely, and many are not updated to reflect real-time market conditions. Markups can be inconsistent, substitutions may be unnecessary, and quantities are often difficult to validate after the fact. Over time, these gaps create a silent drain on facilities budgets.

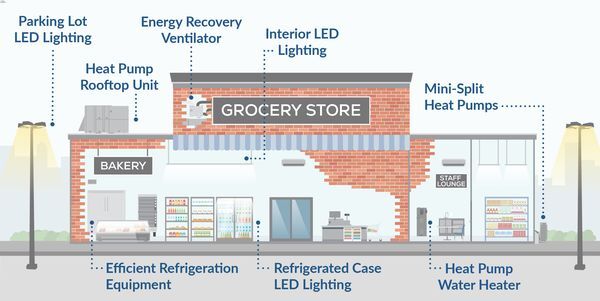

Based on Vixxo data, materials pricing variability is one of the most common contributors to overspend across multi-site portfolios, particularly in plumbing, refrigeration, electrical, and HVAC (Heating, Ventilation, and Air Conditioning).

Why Supplier Catalogs Fall Short

Supplier catalogs are designed for convenience, not cost control. They reflect a provider’s preferred sourcing relationships, regional availability, and internal pricing strategies. What they do not reflect is whether the price aligns with fair market value for that specific part, at that specific time, in that specific geography.

Catalog-based pricing also lacks context. It does not account for whether a part replacement was necessary versus repairable, whether a comparable alternative existed, or whether the quantity billed matched the actual scope of work.

For facilities leaders managing hundreds or thousands of locations, relying on catalogs creates fragmented visibility. Each provider operates within their own pricing universe, making it nearly impossible to compare performance or enforce consistency across the portfolio.

How Market Intelligence Changes the Equation

Market intelligence replaces static pricing references with dynamic benchmarks derived from real-world service data. Instead of asking whether a part appears on a catalog, facilities teams can evaluate whether the price aligns with market norms for that repair, asset type, and region.

Dynamic benchmarking tools analyze thousands of historical transactions to establish expected pricing ranges. When parts pricing exceeds those benchmarks, the variance is flagged immediately. This approach transforms parts management from a passive review process into an active cost containment strategy.

Supplier Catalog Pricing vs Market-Based Benchmarking

Real-World Example: Refrigeration Repair Parts Pricing

A grocery location reports a walk-in cooler temperature issue. The service provider replaces a temperature sensor and submits an invoice that includes parts, labor, and travel:

In a single repair, the cost difference may appear minor. Across dozens of refrigeration calls per store per year and hundreds of locations, inflated parts pricing and unnecessary replacements quietly add hundreds of thousands of dollars to Total Cost of Ownership.

Market-based benchmarking gives facilities teams the ability to validate whether parts are necessary, appropriately priced, and correctly scoped before costs escalate.

The Role of Benchmarking in Predictive TCO

Parts and materials benchmarking does more than reduce current spend. It improves future decision-making.

When facilities leaders understand true market pricing, they can forecast maintenance budgets more accurately, evaluate repair versus replace decisions with confidence, and prioritize capital investments strategically. This visibility supports a predictive approach to TCO, where costs are anticipated and managed proactively rather than explained after the fact.

Facilities Takeaway

Total Cost of Ownership is shaped as much by parts and materials decisions as it is by labor. Supplier catalogs offer convenience, but they do not offer control. Market intelligence provides facilities leaders with the transparency needed to reduce unnecessary replacements, standardize pricing, and protect long-term TCO.

FAQs

What is parts and materials benchmarking in facilities management

Parts and materials benchmarking compares billed pricing against market-based data to determine whether costs align with expected ranges for a given repair, asset type, and geography.

Why are supplier catalogs unreliable for TCO control

Supplier catalogs reflect individual provider pricing strategies and may not represent fair market value or real-time market conditions.

How does benchmarking reduce Total Cost of Ownership

By identifying inflated pricing, unnecessary replacements, and inconsistent markups, benchmarking reduces overspend and improves long-term budget predictability.

Want to talk facilities?

Leave a comment or question below and we'll reach out!